Day trading vs binary options south africa,Many brokers have developed Islamic trading accounts which adhere to Muslim guidance offering immediate execution of trades, and charging no interest. Furthermore, eToro day trading vs binary options South Africa allows you to copy trades of top-performing traders and invest in a specific industry by using its CopyPortfolios feature Binary Options are particularly easy to understand because they are simple financial bets. Unlike CFDs, where the exact profit depends on the amount of the price change, Binary Options only have “cash or nothing”: either the trader makes a profit, the amount of which is fixed in advance, or he loses his bet completely. The fees are already included in the difference between profit and loss /12/21 · A binary option is a type of options in which your profit/loss depends entirely on the outcome of a yes/no market proposition: a binary options trader will either make a

Day Trading With Binaries. Strategy, Brokers and Assets

This is indeed an important question as one cannot really be expected to make money trading either without having a theoretical understanding of how they work and what characteristics they share. You cannot simply jump into binary option trading without knowing where it came from. We will go through the differences and similarities between binary options and traditional options in depth.

An option is a financial instrument that is a derivative on another asset. An option gives the holder the right but not the obligation to buy or sell the underlying asset at some predetermined time in the future, binary options vs day trading. This is why they differ from other derivative instruments such as Futures.

The holder of the option does not have to execute on the underlying contract if it is not profitable for him to do so. Options can be written on a range of financial assets from Equity, to commodities, Forex, interest rates and even bonds and credit ratings.

Options contracts are by no means a new phenomenon in the financial world. They have existed for hundreds of years and first started being offered in ancient Greece as a way for farmers to hedge their olive crops. Since then, they have been used in commodity circles for a number of years. People then started to trade options on equities stock options and interest rates Swaptions. These then evolved into an asset class in their own right which culminated with them officially being traded on the Chicago Mercantile Exchange in This created a large market for them with full liquidity similar to how traditional stock markets would operate, binary options vs day trading.

Option theory can be quite a complicated discipline but there are a few fundamental factors that one needs to know about in order to trade them. Some of these are more relevant for quantitative traders than others but it helps to have an overview of them all.

The Currency price S and the Strike price K are two really important inputs in determining the option price and payoff. The current asset price is self-explanatory and is the price that is prevailing in the market for the asset. The strike price is the agreed upon price that the option holder will either buy or sell the asset at expiry. Time To Expiry This is the predetermined time in the future when the option expires. If the trader has entered into a European optionthen this is the only time at which binary options vs day trading can exercise the option their right to either buy or sell the security.

This is in contrast to the American option where a trader can exit at any time prior to expiry. The option expiry time can range anywhere from end of month to a few years in the future. Option expiry time is also an important point in pricing options as it plays a large role in the time value of the option. This is the notion that, all things held equal, an option with a longer time to expiry is worth more.

CALL or PUT When someone enters a CALL option, they are purchasing the right to buy the asset at some pre-determined rate in the future. When someone buys a PUT option, they are getting the option of selling some asset at some time in the future. Hence, one can think of the CALL option as a trader taking a bullish long view on the asset and the PUT option as the trader taking a bearish short view of the market.

Those are In-The-Money ITM and Out-Of-Money OTM. In essence, what it implies is if it would be profitable for the trader to exercise the option at the current price level.

When the trader holds a CALL option, it is in the money when the price of the asset S is above the strike price K. Conversely, a PUT option is in the money when the price is below the strike. Out of the money options occur when exercising the option is not worth it for the holder and they would rather let the option expire worthless. Price Volatility Option Volatility σ is also an important factor when pricing options. This is because volatility can impact the price movement of the asset to a large degree and hence the option price as well.

Volatility is a measure of how much a price moves around a mean. Generally speaking, options on assets with more volatility are more expensive as there is more chance that the price will swing wildly in or out of the money Payoff At the expiry time of the option, the holder will get a certain payoff. This will only be positive if the option has indeed expired in the money. The payoff will be the difference between the asset price and the strike price S-K if it is a CALL option.

The payoff will binary options vs day trading K-S if it is a PUT option. Premium The option premium is another term for its price. When a trader buys an option, the maximum that they are going to lose on the trade is this premium amount.

Option Example We will take a look at a graphical example of a call option payoff in order to help cement your understanding of how an option would work.

In the image on the right we have a CALL option. We can see that the strike price K of the option is at Looking at the payoff structure, one can see why options have an asymmetric payoff. The maximum loss that the trader can lose is the option premium when the option is out of the money.

On the upside though, the potential profits from holding the option are unlimited. This is the reason why options can be such a profitable derivative instrument, binary options vs day trading. Of course, this is rather simplistic as the option price does vary according to the time to expiry and the volatility in the underlying asset. Given the nature of the payoff and the way that options are priced, there are a number of benefits from trading options.

Although some of these are more applicable to sophisticated investors, binary options vs day trading, retail traders can learn from them. The Trader is in effect taking a leveraged trade on the asset to the upside. When the trader pays the premium then they could theoretically gain a large payoff if their trading turns out the way that they predicted.

This is the option premium that was invested. Unique Strategies Given the asymmetric payoff that one can see for an option trade, this means that the trader can use a number of bespoke option based strategies. Therefore a trader can take a position on an asset that they cannot physically buy. This is because volatility has a large impact on option price and hence traders can take a view on it What is a Binary Option?

Binary options share all of the same binary options vs day trading factors as traditional vanilla options. When pricing binary optionsthe same inputs are used to determine its value.

The only way in which they differ is their pay-out structure on expiry. On expiry of a binary option, the pay-out binary options vs day trading the option is only one of two outcomes. That is either 0 or 1 These are the basics of binary options and how their payoff is determined. This is in contrast to the vanilla option where the payoff is indeed variable on binary options vs day trading upside.

We have included an image on the right that is the pay-out of a binary option on the expiry of that option. Unlike with the traditional options, the payoff is capped at a certain amount, binary options vs day trading.

This means that no matter how high the asset price goes, this will be what the trader will gain. Binary Options have been traded Over the Counter OTC by large investment banks and hedge funds for a number of years.

They were also considered quite difficult assets to trade due to the nature of their payoff. The large market makers who were trading Binary Options with millions in notional binary options vs day trading it hard to hedge the binary outcome. It was not until about that Binary Options started to gain a large degree of interest from the retail market.

Average investors who previously had traded Forex and CFDs now had the opportunity to trade a different type of instrument. Binary Options trading then took on a different form and could allow traders to enter a trade with expiry times of as little at 1 minute which was unheard of in the option industry. Binary Option trades were also simplified down to the point at which the trader could merely decide whether the option was going to go up or down in the next few minutes.

Retail binary options also operated as a European option variant where the trader had to wait until expiry. This is in contrast to most traditional vanilla options where execution can be done prior to expiry.

Indeed, there were a number of traders who merely traded binary options on a hunch and this was more gambling than investing. Binary Options trading morphed from a complicated derivative instrument that investment banks struggled to hedge into a quick and easy way for retail traders to enter the market. Even though most traders sometimes treat binary options as a mere bet on the movement of the underlying instrument, they do enjoy this form of trading.

Unlike binary options vs day trading option trading, the trader does not have to monitor the underlying factors that impact on the price of the option such as those we mentioned above. They merely have to have a view on where they think the asset is likely to go based on a number of different trading signals and indicators. Moreover, binary options vs day trading, traditional option trading is not easily available to most retail traders, binary options vs day trading.

This is because there are usually quite large minimum account requirements to maintain a vanilla option account. If you are a relatively new trader who would merely like to take a view on some asset over a very short period of time then you may be better suited to trading a binary option. However, if you have more funds available and would like to learn about trading options fundamentals then traditional vanilla options could be for you. Please leave this field empty.

Binary Options Contact Us. Binary Options vs. Options, if you are new to trading then you may be slightly confused. What is a binary option and how is it different from a traditional vanilla option?

Join the Club! What is an Option? Some Option Fundamentals Option theory can be quite a complicated discipline but there are a binary options vs day trading fundamental factors that one needs to know about in order to trade them. Current and Strike Price The Currency price S and the Strike price K are two really important inputs in determining the option price and payoff.

Option Example. Benefits of an Option Given the nature of the payoff and the way that options are priced, there are a number of benefits from trading options, binary options vs day trading. Leveraged Trade The Trader is in effect taking a leveraged trade on the asset to the upside. This is because volatility has a large impact on option price and hence traders can take a view on it.

Best Binary Options Strategy 2021 - 2 Min Strategy Live Session!

, time: 13:35Differentiating Binary Options vs Day Trading. - Binbitforex Club

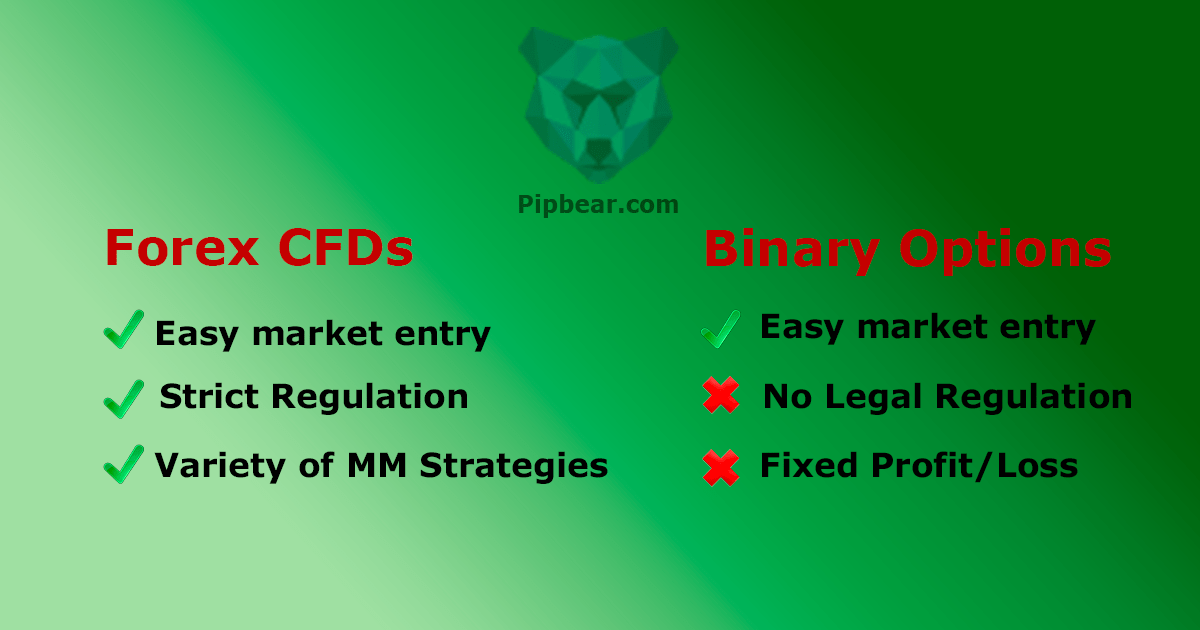

Binary Options have another major advantage over Forex trading: traders can only lose as much as they have just bet on current transactions. If the money for a trade is not in the trading account, the trade cannot be placed Binary Options are particularly easy to understand because they are simple financial bets. Unlike CFDs, where the exact profit depends on the amount of the price change, Binary Options only have “cash or nothing”: either the trader makes a profit, the amount of which is fixed in advance, or he loses his bet completely. The fees are already included in the difference between profit and loss Binary options deposits can be even lower (from just £10), but are traded without margin. Futures require more and stocks require the most money to be invested in for day trading. Binary options offer low cost entry for anyone wishing to day trade. Their drawback however, is a lack of leverage

No comments:

Post a Comment