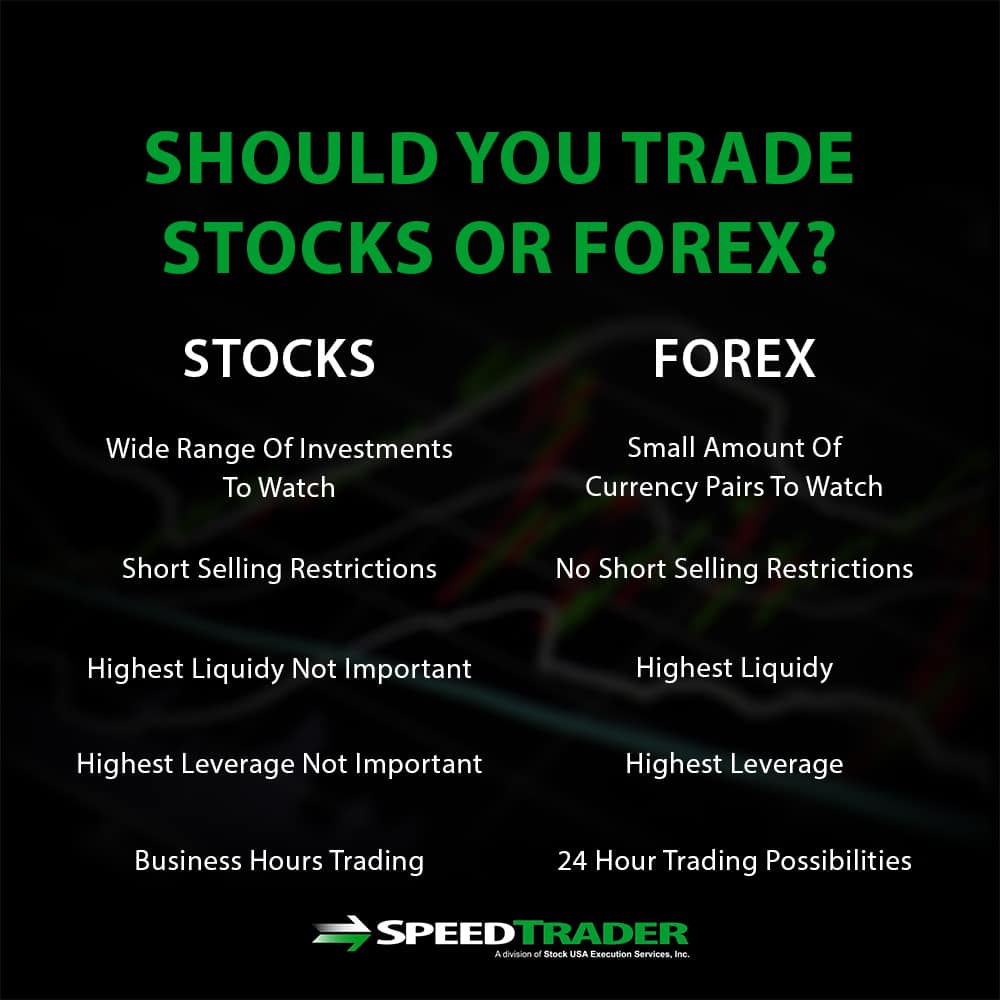

/11/29 · The Forex Vs Stocks debate is a very broad one since both markets are great ways to make money and both industries have a wide number of professionals who make a living trading one or the other. (Lots of people trade both forex and stocks). Size of Forex Vs Stock Market There really is no definite answer /07/07 · The forex market is more accessible than stock markets. It is an over the counter (OTC) market where trading is facilitated through the global network, called the interbank market. This means that forex trading can be executed worldwide during different trading sessions of Forex is what has the lowest volatility, so it’s the worse one to trade, especially short-term. Indices are in the middle, between forex and stocks. They are an excellent option for day trading. Keep in mind that you need volatility to trade

Trading forex vs stocks vs indices. Which one is better? - Living From Trading

Today's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange or forex markets.

Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to forex vs stocks the best choice. The most important element may be the trader's or investor's risk tolerance and trading style. For example, buy-and-hold investors are often more suited to participating in the stock market, while short-term traders—including swing, day and scalp traders—may prefer forex whose price volatility is more pronounced.

Blue chipson the other hand, are stocks of well-established and financially sound companies. These equities are generally able to operate profitably during challenging economic conditions and have a history of paying dividends.

Blue chip stocks are generally considered to be less volatile than many other investments and are often used to provide steady growth potential to investors' portfolios. So what would be the key differences to consider when comparing a forex investment with one in blue chips? Stock market indexes are a combination of stocks, with some sort forex vs stocks element—either fundamental or financial—which can be used as a benchmark for a particular sector or the broad market.

In the U. The indexes provide traders and investors with an important method of gauging the movement of the overall market. A range of products provide traders and investors broad market exposure through stock market indexes. Stock index futures and e-mini index futures are other popular instruments based on the underlying indexes. The e-minis boast strong liquidity and have become favorites among short-term traders because of favorable average daily price ranges. In addition, the contract size is much more affordable than the full-sized stock index futures contracts.

So what would be the key differences to consider when comparing a forex investment with one that plays an index? These various trading instruments are treated differently at tax time. Short-term gains on forex vs stocks contracts, for example, may be eligible for lower tax rates than short-term gains on stocks. In order to claim MTM status, the IRS expects trading to be the individual's primary business.

IRS Publication covers the basic guidelines on how to properly qualify as a trader for tax purposes. The internet and electronic trading have opened the doors to active traders and investors around the world to participate in a growing variety of markets. The decision to trade stocks, forex or futures contracts is often based on risk tolerance, account size, and convenience.

If an active trader is not available during regular market hours to enter, exit or properly manage trades, forex vs stocks, stocks are not the best option. However, if an investor's market strategy is to buy and hold for the long term, generating steady growth and earning dividends, forex vs stocks, stocks are a practical choice. The instrument s a trader or investor selects should be based on which is the best fit of strategies, forex vs stocks, goals, and risk tolerance.

Bank for International Settlements. Internal Revenue Service. Accessed August 16, Forex vs stocks Trading. Financial Futures Trading. Stock Trading. Penny Stock Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Contents Forex vs stocks. Comparing Forex to Blue Chip Stocks. Comparing Forex to Indexes. Tax Treatment: Forex Vs. The Bottom Line. Specific elements to compare include volatility, leverage, and market trading hours. Broadly speaking, the equities markets—blue chip stocks and index funds—suit a buy-and-hold investor, while active traders often prefer the fast-moving forex.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Take the Next Forex vs stocks to Invest. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Day Trading Activities to Take Advantage of in Pre-Market and After-Hours Trading. Stock Trading How to Trade Dow Jones Index Futures.

Stock Trading What Do Nasdaq Futures and Other Futures Contracts Represent? Penny Stock Trading Who Actually Trades or Invests in Penny Stocks? Partner Links. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Erroneous Trade Definition and Examples An erroneous trade is a stock transaction that deviates so much from the current market price that it is considered forex vs stocks error and may be reversible.

How Big Is a Tick Size? Tick size is the minimum price amount a security can move in an exchange, forex vs stocks. It's expressed in decimal points, forex vs stocks, which in U. Financial Markets Financial markets refer broadly to any marketplace where the trading of securities occurs, including the stock market and bond markets, among others.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family, forex vs stocks.

What's the overall difference between trading stocks and forex?

, time: 4:44What Should You Trade - Forex vs Stocks - Admirals

Forex markets sometimes exhibit greater sensitivity to emerging political and economic situations in other countries; the U.S. stock market isn't immune but is usually less sensitive to such foreign issues. Price Sensitivity to Trade Activity The two markets have very different price sensitivity to trade activity Forex is what has the lowest volatility, so it’s the worse one to trade, especially short-term. Indices are in the middle, between forex and stocks. They are an excellent option for day trading. Keep in mind that you need volatility to trade Forex vs stock investment – Pros and cons of stocks While talking about the advantages of stock trading, it should be noted that this market is a much better option for those who want a long-term investment option. Another huge advantage is that there are much more options when it comes to stock trading than in Forex

No comments:

Post a Comment