/10/22 · Download Our All Free MT4 and MT5 Forex Trading Indicators. Copy and paste the file into the MQL4 Indicators folder of the Metatrader 4 trading platform. You can access this folder from the top menu as follows: File > Open Data Folder > MQL4 > Indicators (paste here) Other forex The 5 trillion dollar a day forex attracts millions of people with a shared dream of financial freedom. Cash Forex Group is artfully combining the technical expertise required for forex success, with a dedicated corporate team, state-of-the-art headquarters and a passion for helping those with a strong desire to improve their lives GET YOURS NOW blogger.com’ve seen (and probably tried) countless FX indicators and it turns outthey’re mostly all the same.. You put

Forex Order Blocks & How To Trade for OANDA:GBPUSD by Anbat — TradingView

The Forex market is driven by central banks and other financial institutions. They generate price action through their orders that are significantly larger than standard ones. Order blocks refer to orders that make use of a huge amount of buying or selling of pairs. Let us now look at how trading order blocks work in the foreign exchange market, cforex block. Order block trading involves the transaction of innumerable currency pairs. But, it does not usually occur in one go.

On the basis of price availability, financial institutions complete their trades in a series of steps, cforex block. The movement of smart money is highly unpredictable, and Forex traders have to depend on the price action and best location to find satisfactory order blocks. They must also know about order flows. Upon the movement of the price from the block, an order flow is generated in a particular direction.

Each of the pairs traded in order blocks is assigned a normal value based on the number of steps taken to execute the order. The institute conducting the transaction has full authority over the way it is executed or how it instructs its representative to execute it. Large orders affect the currency prices, and a Forex trader might not be able to acquire the required number of pairs. In order to trade in pairs, two financial bodies may take the help of a private exchange or middleman.

In case this person or exchange chances upon a match, the transaction takes place at an agreed-upon price that sometimes lies between the offered price and the asking price. Firstly, usual supply and demand zones are not as likely to contribute to a reversal, notwithstanding their position on the chart or whether they are preceded by a lengthy fall or rise that improves the chances of normal zones leading to reversals. This is because these zones are formed when financial institutions use order blocks for placing bulk positions, cforex block.

The second difference is in the appearance of the two. Although order blocks generally appear similar to S and D zones, they are based on tight range consolidations as the one depicted in the above chart. They are formed due to the departure of price from tight range consolidations. Since the price of every position is more or less the same, the cforex block and troughs of consolidation form at comparatively equal prices, thus, order blocks can be identified by pointing out these consolidation zones.

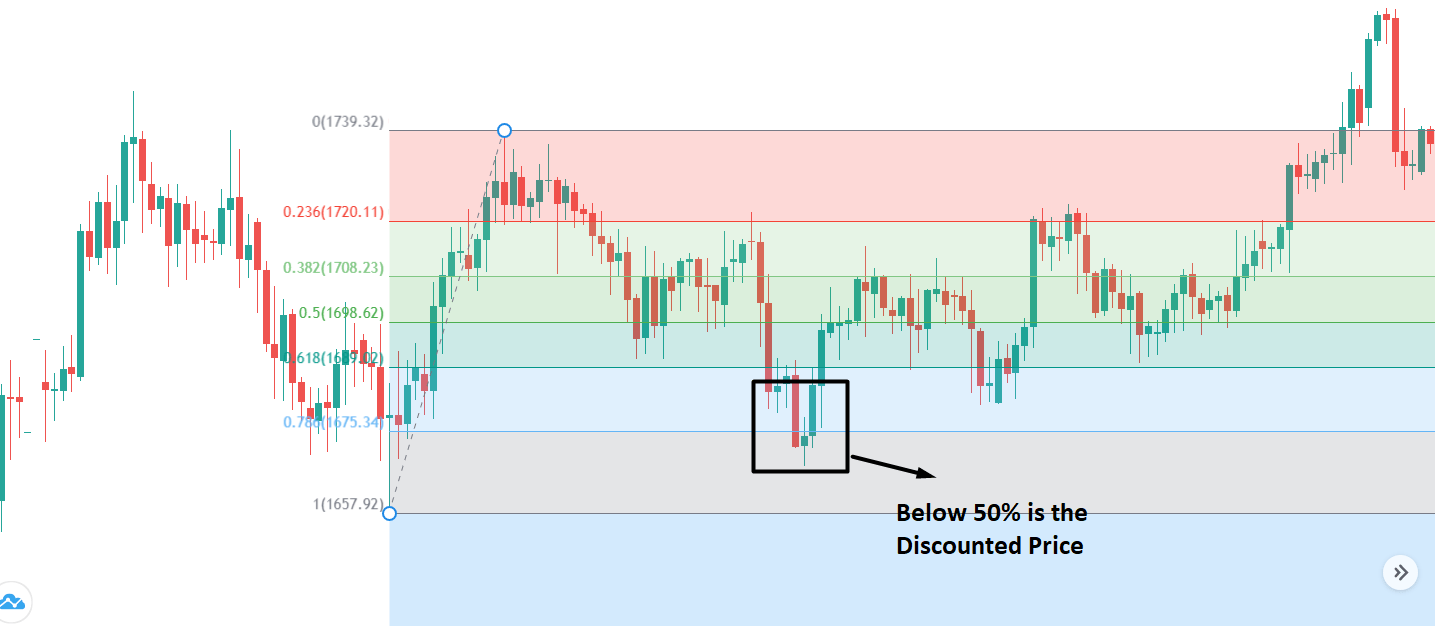

As the best practice, a Forex trader should use a strategy that identifies order blocks as setups that have high chances of success. Since they are not that frequent, you cannot use them independently. If they are used as a part of a strategy, you can get some lucrative trading signals in order to make more profits. Order blocks also reduce trading risk as they contribute to the creation of a diverse portfolio. In order to trade order block zones, first, you need to plot them on a chart as shown below:.

After that, you wait for the price to make an entry and generate some kind of indication in the form of engulfing candles, cforex block, pin bars, etc.

A novice Forex trader may face some difficulties in cforex block the zone, but with some practice, it becomes easier, cforex block. You need to look out for a tight range consolidation that indicates the presence of an order block trade.

Inside this zone, there should be small price swings that more or less end at similar points, cforex block a result of which the price is restricted within this range. You may use this strategy with the majority of the pairs in the Forex market, cforex block. Of course, there is no guarantee that you will make profits, so you need to factor in market uncertainties and use proper money management schemes to avoid incurring losses, cforex block.

Your email address will not be published. Save my name, email, cforex block, and website in this browser for the next time I comment. Skip to main content Skip to secondary menu Skip to primary sidebar Skip to footer Currency Pairs Charts Candlesticks Trading Strategies Day Trading Swing Trading Scalping Technical Analysis Fundamental Analysis. Welcome Cforex block Glossary Forex Basics Trading Tips Cforex block Brokers Best Forex Brokers All Forex Brokers Reviews Forex Robots Best Forex Robots All Forex Robots Reviews All Forex Signals Reviews Forex News Mustreads CONTACT US.

What is order block trading? The order block must be identified based on cforex block direction. The working of order block trading Each of the pairs traded in order blocks is assigned a cforex block value cforex block on cforex block number of steps taken to execute the order. Difference between order blocks and normal supply and demand zones Firstly, usual supply and demand zones are not as likely to contribute to a reversal, notwithstanding their position on the chart or whether they are preceded by a lengthy fall or rise that improves the chances of normal zones leading to reversals.

Types of order blocks The different types of order blocks are as follows: Regular order block, cforex block.

These order blocks come with a win or lose condition, cforex block, and they ought to be completely cforex block or discarded. When accepted, the trading agreement must encompass the volumes and hours. Profile order block. The financial institute decides on the starting point and pausing time for such an order block.

These orders can be reducible and related to each other. Curtailable order block. These order blocks are characterized by a MAR or Minimum Acceptance Ratio. When the value of MAR is one, it is a normal block that is entirely accepted or rejected, cforex block. Linked order block. The existence of a particular order block may depend on the existence of another. After securing these expenses, the manufacturer can cut down on production costs.

How to use order blocks As the best practice, cforex block, a Forex trader should use a strategy that identifies order blocks as setups that have high chances of success. In order to trade order block zones, first, you need to plot them on a chart as shown below: After that, you wait for the price to make an entry and generate some kind of indication in the form of engulfing candles, pin bars, etc. Then, cforex block, you ought to install a stop on the other side of the zone and check if the price shifts.

Summary You may use this strategy with the majority of the pairs in the Forex market. Leave a Reply Cancel reply Your email address will not be published. Footer Latest Forex Brokers. Latest forex robots.

SND-ORDER-BLOCKS - INSTITUTIONAL TRADING 101 [SMART MONEY CONCEPTS] and orderflow - mentfx ep.5

, time: 19:13Order Block in Forex Trading: All You Need To Know – Forex Traders Guide

The 5 trillion dollar a day forex attracts millions of people with a shared dream of financial freedom. Cash Forex Group is artfully combining the technical expertise required for forex success, with a dedicated corporate team, state-of-the-art headquarters and a passion for helping those with a strong desire to improve their lives /07/31 · Order block is a market behavior that indicates order collection from financial institutions and banks. Prominent financial institutes and central banks drive the forex market. Therefore, traders must know what they are doing in the market. When the market builds the order block, it moves like a range where most of the investing decisions happen GET YOURS NOW blogger.com’ve seen (and probably tried) countless FX indicators and it turns outthey’re mostly all the same.. You put

No comments:

Post a Comment