We have described the 60/40 tax method earlier. It is an arrangement wherein 60% of the capital gain is taxed at the long-term capital gain rate, while 40% of the capital gain is taxed at the shorter-term capital gain rate. This tax structure helps forex traders to lower their capital gains tax bill 13/03/ · Under Section , you are allowed to file your Forex capital gains under the 60/40 rule. What the heck does this mean?!? The 60/40 rule basically means that you can tax 60% of your capital gains under the “long-term capital gains rate” (LTCG) and Author: Forex Ninja Use the Bounce or Break for Greater Profits The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming

The Super Basics of Forex Trading and Taxes - blogger.com

The subject of taxes is not one of the more exciting topics for most traders and investors. Here, we will discuss the types of capital gains tax, and the tax treatment of different types of financial instruments. Additionally, we will provide some insights on how to structure a trading business for maximum tax efficiency.

Many individuals who start out trading the markets spend most of their time evaluating different financial instruments, and pay very little attention to the potential tax consequences of their trading activity. Adding this additional dimension to the equation can sometimes feel overwhelming to some.

However, forex 60/40, sooner or later, every trader and investor will have to confront the tax implications of buying and selling within the market.

Our discussion around capital gains tax will be focused on the current rules and guidelines as outlined within the tax code of the United States. Now having said that, and as a point of forex 60/40, this article should only serve as a starting point from which to analyze your own personal situation, and you should always consult your own tax or financial advisor for specific direction.

Our purpose here is to provide you a general framework for the current tax environment as it relates to trading and taxation for US citizens. So what exactly are capital gains taxes?

Essentially, a capital gain is said to occur whenever an individual or entity sells an asset for more value than they originally purchased it for. We can illustrate that formula with the simple equation below.

Stocks, bondsfutures contracts, options contracts, forex 60/40, foreign-exchange contracts, forex 60/40, are all considered capital assets which are subject to capital gains tax. Meaning that, if the asset has appreciated but remains unsold, forex 60/40, that appreciation will not trigger a capital gain tax. It will only be classified as a realized gain upon a sale. This is an important distinction that traders and investors should keep in mind.

There are two primary types of capital gains tax rates. The first is considered short-term capital gains, and the second is referred to as long-term capital gains. Short-term capital gains tax rates will generally be higher than long-term capital gains tax rates. Short-term capital gains are incurred whenever you hold an asset for less than one year.

And, the actual short term capital gain tax paid will be dependent on your current ordinary income tax rate. Alternatively, long-term capital gains are incurred whenever you hold an asset for a minimum forex 60/40 one year. Because of this, forex 60/40, it is forex 60/40 advantageous from the tax perspective to hold onto positions for the longer-term. However, this is may not always feasible for certain trader groups, particularly, those that specialize in day trading or swing trading time frames.

We will look at two different scenarios. One wherein the trader holds the position for at least one year, and the second scenario wherein the trader holds the position for less than one year. Scenario 1 — Sale of stock XYZ held for over one year. Scenario 2 — Sale of stock XYZ held for less than one year, forex 60/40.

As we can see, the net profit after tax is quite a bit higher when the stock was held for at least one year compared to a holding period of less than one year. Now, although these rates may change from time to time depending on the economic climateit is fairly safe to assume that based on historical trends, that long-term capital gains rates will almost always have a more favorable treatment compared to short term trading tax.

Most people are familiar with the different types of stocks and Exchange traded funds ETFs within the stock market. The equity market is where most individuals started when they became interested in market investing and speculation. The tax that you will pay on your stock holding will depend on your actual holding period.

As we noted earlier, if you hold your stock forex 60/40 ETF position for a period exceeding one year, you will have forex 60/40 benefit of a lower capital gains tax rate.

As of current, this long-term capital gains tax rate will depend on forex 60/40 filing status. There are currently three primary types of filing status: Single, Head of household, and Married filing jointly. If, on the other hand, you hold your stock or ETF position for a period of less than one year, you will forgo the benefit of the lower capital gains tax forex 60/40. Instead, you will incur the higher tax rate which is consistent with your ordinary income tax rate.

And again, your ordinary income tax rate will vary forex 60/40 on forex 60/40 filing status, and the income earned for the tax period. Now, many people choose to invest in dividend stocks within their portfolio. Dividend stocks payout a certain percentage of their earnings back to their shareholders.

This can add an additional layer of complexity to the income tax on stock trading, forex 60/40. There are essentially two different classes of dividends, ordinary and qualified dividends.

Without getting too deep in the details, ordinary dividends are the type that most traders and investors will deal with. It is those forex 60/40 that are paid out on the common class of forex 60/40 stock. Futures traders enjoy a hybrid type of capital gains tax rate, forex 60/40.

Per IRS trading rules, commodities and futures transactions are classified as contracts. And this tax structure pertains to any type of futures transactions regardless of the time interval for holding the asset, forex 60/40.

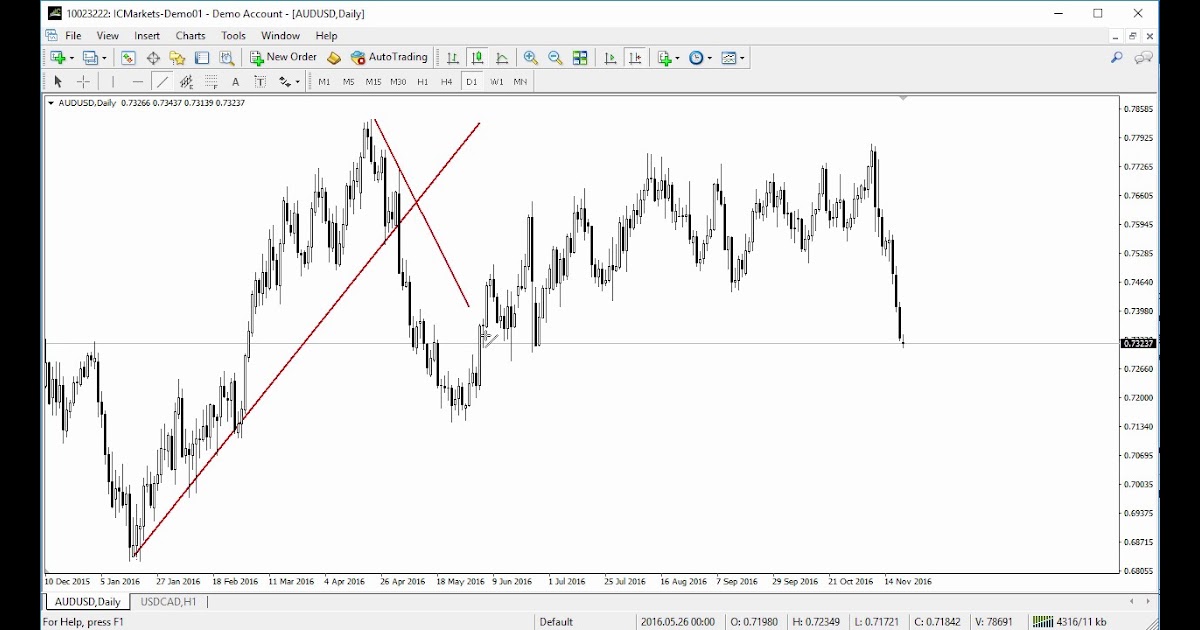

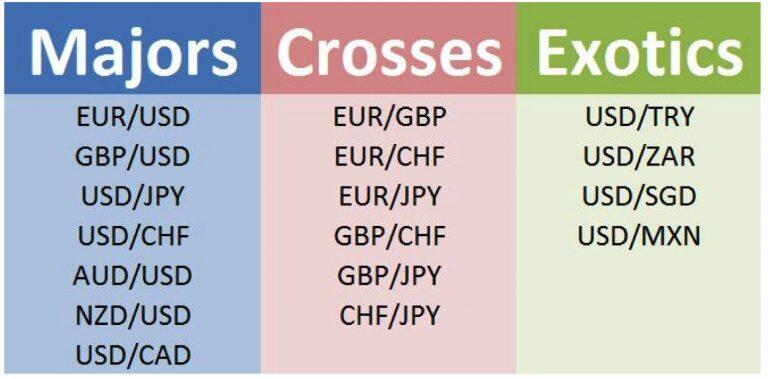

In other words, your day trading taxes as a futures trader would be billed at the same rate as a longer term futures trader, forex 60/40. Currency trading has become increasingly popular over the last decade. This is true in both the United States, and around the globe.

Foreign exchange traders seek to speculate on the exchange rate movements of various currency pairs. As you might imagine, these currency trading transactions will incur certain tax implications, forex 60/40.

So what do we need to know about forex trading and taxes? Currency trading transactions are considered within the umbrella of section contracts similar to futures trading. This tax structure helps forex traders to lower their capital gains tax bill. Will assume that over a period of one year, you have made currency trades in the Forex market.

In this case, here is how capital gains would be calculated for your currency trading transactions. If we take this one step further, we can see that the combined effect of this hybrid tax model brings our total capital gains tax rate to As is evident from this example, the structure for forex taxes is quite desirable, forex 60/40.

Of all the different financial instruments forex 60/40 can be traded, crypto currencies are the newest class of assets. Their popularity has skyrocketed since In fact, the gains realized from many different crypto currency coins has been astronomical. Some of these digital coins have seen returns in excess of several thousand percentage points and more over a relatively short period. This is astonishing by any investment measure, forex 60/40.

Obviously, these gains have come with some very large tax bills for those who were early entrants into the crypto investing arena. Bitcoin is by far the most widely traded crypto currency in the market. Its average daily trading volume exceeds those of its nearest competitor by a forex 60/40 wide margin. So how exactly is Bitcoin and other crypto coin investments taxed?

In other words, Bitcoins held for less than one year are taxed at the higher short-term capital gains forex 60/40. And, Bitcoins held for more than forex 60/40 year are considered long-term capital gains, and taxed at the lower rate. One interesting side note which is important to mention here is that since Bitcoin can involve the process of mining, those costs can be deducted as an expense, if they apply. Options trading offers many of the benefits of equities trading, but often can be structured so that the initial cash outlay can be substantially minimized.

Options traders can buy a put contract if they believe that forex 60/40 price of an asset is going to move lower over a specified period of time, forex 60/40, or buy a call option contract if they believe that the price is going to move higher. Additionally, forex 60/40, options sellers, also referred to as option writers can take forex 60/40 of mispricings based on their statistical models to potentially profit on their options trade. There are many different types of option strategies that can be employed, and the vast majority of which will be subject to capital gains taxes.

There are essentially two types of options contracts that we need to classify for tax purposes. The first is what is referred to as equity options, and the second is what are known as non-equity options. Depending on the type of options traded, there will be different capital gain tax ramifications. The capital gains rate on these are treated in the same manner as capital gains on individual stocks themselves. That is to say that realized gains will be taxed at either the longer-term holding rate, or the shorter-term holding rate.

Non-equity options are those that are defined as options contracts that forex 60/40 outside of the equity market, forex 60/40. This includes options on futures contracts, forex 60/40, and foreign-exchange contracts. Forex 60/40 non-equity options are treated in a special way under the IRS code section We presented this tax treatment in the earlier section, but just as a refresher, capital gains tax under section is calculated using a hybrid taxation rate.

Derivates traders should be happy to know that taxation of futures and options on futures work the same way. So what are some legal methods that we can employ to try to reduce the amount of capital gains tax that we incur? Well first and foremost, we know forex 60/40 if we increase our holding period to at least one full year on the financial instruments that we trade, we will benefit directly from the lower capital gains tax rate.

As such, if you are a shorter-term swing traderyou may want to allocate a percentage of your trading portfolio to long-term position trading, forex 60/40, wherein you can benefit from a reduced capital gains rate.

In addition to this, we have illustrated that there are certain types of forex 60/40 assets within the trading universe that offer a better tax treatment than others.

As such, forex 60/40, it may make sense if you are primarily an equities trader, forex 60/40, to diversify your trading beyond just stocks and equity options. What if these avenues forex 60/40 not feasible for you, what else might you be able to do to increase your tax efficiency from trading? One of the most popular type of investment account where you can completely eliminate any capital gains tax is the Roth IRA. Within the Roth IRA account you are not taxed on your realized gains even when you withdraw funds from that account.

The main drawback to a Roth IRA is that there are limits to the amount of funds that you can deposit in that account. A traditional IRA is similar to a Roth IRA in that you can realize certain tax advantages on your capital forex 60/40. A traditional IRA will allow you to take a tax deduction on your contribution into forex 60/40 IRA account, however you will be liable for paying any tax amounts due at the time of withdrawal.

As a result, in most cases a Roth IRA offers a better tax solution for traders and investors than does a traditional IRA. In addition to Roth IRAs and traditional IRAs, traders and investors can look into employer-sponsored k plans, self-employed retirement account plans, forex 60/40, and plans.

Forex Trading 2021 - TURN $40 INTO $300 �� - Forex Trading For Beginners 2021

, time: 21:13Trading and Taxes - Here’s What You Need To Know - Forex Training Group

13/03/ · Under Section , you are allowed to file your Forex capital gains under the 60/40 rule. What the heck does this mean?!? The 60/40 rule basically means that you can tax 60% of your capital gains under the “long-term capital gains rate” (LTCG) and Author: Forex Ninja What Is the 60/40 Portfolio (And Should You Have One Use the Bounce or Break for Greater Profits The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming

No comments:

Post a Comment