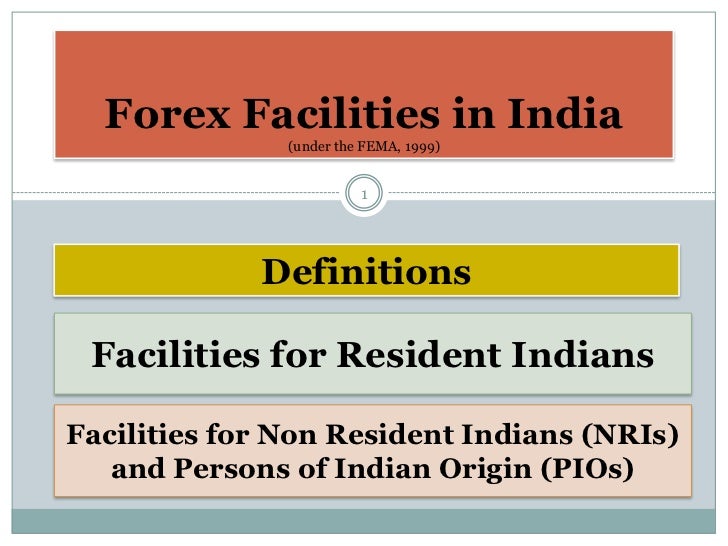

· Foreign Exchange is defined as a Foreign Currency under the Sec 2(n) of the FEMA,6and Foreign Currency as defined by FEMA under Sec 2(m) is a currency other than an Indian Currency.7But the Cryptocurrencies are not considered currency under the FEMA and Trading non-INR Forex pairs are illegal in India under the FEMA act. So, the government has not forbidden Indians to trade Forex. They have limited trading for Indian residents to only trade currency pairs bench-marked against INR (Indian Rupee) Hello everybody, my name Forex Under Fema i Rachell, jut want you to know about my own experience. 2 month ago, I made a requet to thi following webite blogger.com becaue I wa really tired to loe my money on trading without any hope to give them back. I made a concluion to be an independent broker.9,7/10()

Legality of forex trading in India - iPleaders

What is it? FEMA was enacted by the Parliament of India in the forex under fema session of to replace the Foreign Exchange Regulation Act FERA of The RBI proposed FEMA in to administrate foreign trade and exchange transactions. The Foreign Exchange Management Act officially came into force on 1st June Thus forex under fema forex market in India is regulated by RBI and its arrival paved the way for the introduction of the Prevention of Money Laundering Act PMLA of Most significantly, forex under fema, FEMA regarded all forex-related offences as civil offences, whereas FERA regarded them as criminal offences.

Additionally, there were other important facts such as:. It did not apply to Indian citizens who resided outside India. The eligilibity was checked by calculating the number of days a person resided in India during the previous financial year days or more to be a resident. So these were the standard norms for a person to be recognized as an authorized entity under FEMA, forex under fema. FEMA authorized the central government to impose restrictions on and supervise three things — payments made to any person outside India or receipts from them, forex, and foreign security deals.

As per the law, foreign exchange transactions have been divided into two categories - capital account and current account. A capital account transaction altered the assets and liabilities outside India or inside India but of a person resident outside India. Thus, any transaction that changed overseas assets and liabilities for an Indian resident in a foreign country, or vice versa, was classified as a capital account transaction.

Any other transaction fell into the current account category. FEMA also gave the RBI the authority to regulate capital account transactions. Under The Foreign Exchange Management Act, the central government issued the Foreign Exchange Management Current Account Transaction Rules of which restricted forex deals made by authorised persons under their current forex under fema. Additionally, Nepal and Bhutan allowed the use of Indian currency for local transactions, and the citizens of these countries were considered at par with Indian citizens from a legal standpoint.

Because of these provisions allowing for a common currency market in India, Nepal and Bhutan, use of forex for transactions in — or with the residents of — Nepal and Bhutan was also prohibited. Moreover, forex under fema, FEMA recognized the growing international presence of Indians as well as the rising contribution of Non Resident Indians NRIs to the Indian economy.

Also it is applicable for a variety of purposes that include international travel to any country except Nepal and Bhutangifts, donations, travel for overseas employment, emigration and maintenance of close relatives living abroad. The RBI was the overall controlling authority as far as foreign exchange management was concerned. It worked with and empowered the central bank to specify the different classes forex under fema capital account transactions along with the exchange rate admissible for each such transaction, forex under fema.

Authorised persons could facilitate forex trading; however, the Act empowered the RBI to put several restrictions on their capital account. Authorized persons were expected to provide details and forex under fema regarding forex transactions to the RBI on a regular basis, forex under fema.

FEMA law forex under fema Indian residents to carry out transactions in forex, foreign security, or to own immovable property abroad. FEMA compliance covered forex transactions and remittances which included individuals or entrepreneurs moving money in or out of India, or exchanging foreign currency in India for travel purposes. There were many subsequent regulations and functions issued under the Act addressing specific issues such as authentication of documents, current account transactions, adjudication proceedings and appeal, compounding proceedings, permissible capital account transactions and borrowing or lending in forex, amongst others.

As per the rules defined under FEMA, there are few limits determined such as -- if a person enacts a breach against quota, the penalty will be thrice the sum.

Events where the forex under fema is not quantifiable, the penalty imposed remains up to Rs. In occurrences where the violation continues on a daily basis, the amount stands at Rs. Also, if there is any kind of property which is involved during the course the asset will be confiscated and considered as a fee under contravention of law. Indeed, FEMA was drafted to create a more liberal foreign exchange market in India.

The Act encouraged deregulation of foreign exchange and smooth international trade. FEMA also has a distinct administrative difference from FERA, which sought to impose sweeping regulations on every aspect of India forex transactions. On the other hand, forex under fema, FEMA aimed to manage only certain forex transactions that might have an impact on national security and the wider national economy, and opened up individual forex transactions to the free market.

This includes specific guidance on FEMA-applicable areas and export businesses within India as well as all branches, offices, and agencies located outside India that are owned or controlled by a resident of India. When FERA was introduced inthe Indian economy was suffering from an all-time low of foreign exchange forex reserves. To rebuild these reserves, the government took a stance that all forex earned by Indian residents -- living within India or abroad -- belonged to the Government of India and had to be surrendered to the Reserve Bank of India RBI, forex under fema.

However, the objective of FERA did not quite have the effect that was envisioned and the Indian economy continued to decline. These concessions made FERA largely irrelevant under the new economic regime. And so FERA in India was replaced by FEMA, forex under fema. Trade Advice. Foreign Exchange Management Act FEMA All you need to know. What is FEMA ACT? Objectives of FEMA Act Following are the most important objectives of FEMA:- Facilitating external trade and payments Promoting the orderly development and maintenance of foreign exchange market in India Defining formalities and procedures for all forex transactions in India 3.

Guidelines and Regulations for outward remittances under FEMA Most significantly, FEMA regarded all forex under fema offences as civil offences, whereas FERA regarded them as criminal offences. Additionally, there were other important facts such as: It did not apply to Indian citizens who resided outside India.

Capital Account Transactions under FEMA FEMA also gave the RBI the authority to regulate capital account transactions. Current Account Transaction under FEMA Under The Foreign Exchange Management Act, the central government issued the Foreign Exchange Management Current Account Transaction Rules of which restricted forex deals made by authorised persons under their current account. Features and Provisions under FEMA The RBI was the overall controlling authority as far as foreign exchange management was concerned.

Difference between FERA and FEMA When FERA was introduced inthe Indian economy was suffering from an all-time low of foreign exchange forex reserves. Raghav Khajuria Leads Marketing activities for Drip Capital. Trade Advice View More View Less. Opinion View More View Less. Industry Insights View More View Less.

5 FEMA Rules An NRI Must Know

, time: 3:09Under the FEMA act, can we not do Forex trading in India on portals like Alpari and iForex? - Quora

Trading non-INR Forex pairs are illegal in India under the FEMA act. So, the government has not forbidden Indians to trade Forex. They have limited trading for Indian residents to only trade currency pairs bench-marked against INR (Indian Rupee) · Section 2 (n) of the Foreign Exchange Management Act (FEMA) defines foreign exchange as including: Deposits, credits and balances that are payable in foreign currency. Drafts, travellers’ cheques, letters of credit or bills of exchange that are payable in Author: Ayush Verma FEMA considers all forex-associated offenses as civil offenses whereas FERA considers them as a criminal offense. It can be counted as one of the features of FEMA. Other essential features and guidelines of FEMA compliance are as follows: FEMA will not apply to

No comments:

Post a Comment