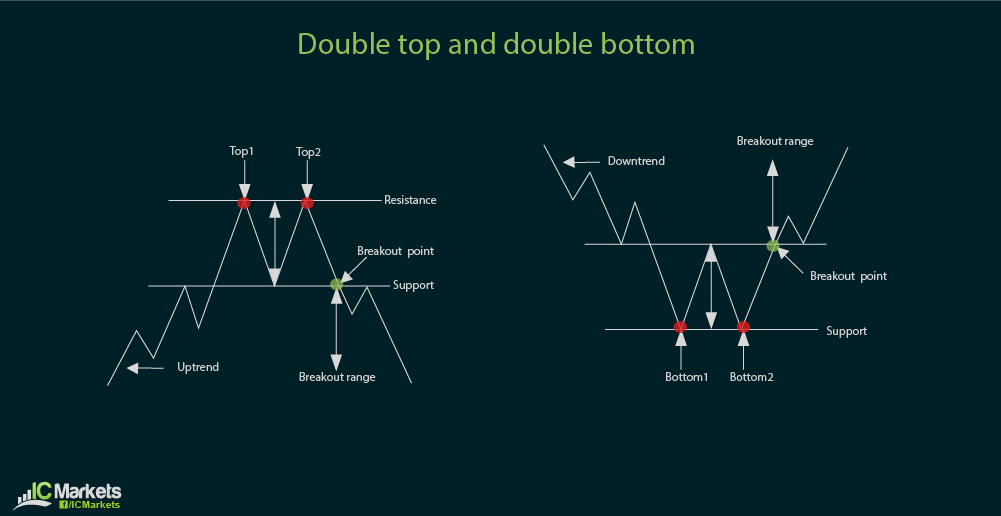

If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.. Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on.. In this lesson, we covered six chart patterns that give reversal signals By now you have an arsenal of weapons to use when you battle the market. In this lesson, you will add yet another weapon: CHART PATTERNS! Think of chart patterns as a land mine detector because, once you finish this lesson, you will be able to spot “explosions” on the charts before they even happen, potentially making you a lot of money in the process 13/05/ · Our Top Forex Chart Patterns. Now that we have shared the chart patterns basics, we would like to let you know which are the best chart patterns for intraday trading. Then we will give you a detailed explanation of the structure and the respective rules for each one. So our top Forex Chart patterns are: Flags and Pennants; Double Top and Double

Chart Patterns - Part 1 | Forex Trading Basics | WaveFX Trading

When you look at price on a chart there are only so many ways that it can move, after all we are only talking 2D here. Price can only go up, down, forex basic chart patterns, or sideways.

Understanding every possible situation that could play out is actually not that hard. At the end of these lessons you should know them all, forex basic chart patterns. All price movements can be understood with a few simple patterns, forex basic chart patterns. If you spend some time understanding the logic of why this is, you will be able to react to them as they forex basic chart patterns themselves.

Eventually, you will be able to forex basic chart patterns read what the next probable moves that price could make are. When price is moving up or down it will always still be in a competition for direction. This means it will never be a straight line. The up or the down movement needs to be viewed in a pattern format. This is created by the tug of war between the buyers and the sellers.

The overall direction of the pattern is what will give you the up or the down movement as a whole. In the case of the bearish downtrend, the sellers have control of the market.

This is clearly signified by the lower highs LH and lower lows LL that are being made. The piece of this pattern that you would want to be trading as forex basic chart patterns trend continuation style of trade, would be the 3rd wave of selling. In the case of the bullish uptrend, the buyers have control of the market. This is clearly signified by the higher lows HL and higher highs HH that are being made.

The piece of this pattern that you would want to be trading as a trend continuation style of trade, would be the 3rd wave of buying. What you are doing here is waiting for a trend to be established and then joining in for the first wave of a confirmed trend the 3rd wave. You could then go on to trade the 4th and 5th waves in the same direction if there was room for the overall directional move to run. How you can judge that will become clearer to you over time but for now just understand that the 3rd wave is always going to be the safest.

The 4th and 5th waves are less common and need a higher level of experience to attempt. Price Movement Creates Chart Patterns When you look at price on a chart there are only so many ways that it can move, after all we are only talking 2D here. Trend Continuation Patterns When price is moving up or down it will always still be in a competition for direction.

The piece of this pattern that you would want to be trading as a trend continuation style of trade, would be the 3rd wave of selling In the case of the bullish uptrend, the buyers have control of the market. Forex Trading Basics What is Forex? The Forex Market Hours Making Money With Forex Fundamental Analysis Technical Analysis Popular Forex Charts Japanese Candlesticks Price Based Forex Charts Chart Patterns — Part 1 Chart Patterns — Part 2 Chart Patterns — Part 3 Forex Market Layers Support and Resistance Forex Trading Psychology Forex Trading Strategy.

Read More. Copyright © WaveFX Trading ® All Rights Reserved Privacy Risk Disclaimer Partners - Affiliates Sitemap Contact. Twitter Facebook Instagram YouTube Pinterest.

10 Powerful Trading Patterns - Understanding The Process

, time: 14:22The Chart Patterns Basics [Forex Software]

16/10/ · Basic Patterns Illustration. We shall look at the detailed way of identifying and trading these patterns on a chart in the next article. Having looked at the patterns, It is also important to note that we have 2 ways of placing our trades. We can at times chose to take trades on both break outs and risk entry positions 14/05/ · Basics of Harmonic Chart Patterns in Forex. Most of the technical chart patterns like heads and shoulders, double tops, triangles and so on are defined mainly by their appearance. In another branch of chart analysis called harmonics the patterns are recognized by the exact retracements ratios between each reversal Basic Candlestick Patterns Candlesticks are created by up and down movements in the price. While these price movements sometimes appear random, at other times they form patterns that traders use

No comments:

Post a Comment