20/06/ · Using the Chandelier Exit as a trailing stop in trading includes using volatility that is based on the Average True Range Indicator. The name “Chandelier” is no mistake as the indicator calculation “hangs” from the highs (or lows) of current blogger.comted Reading Time: 5 mins Using Chandelier Exit in Forex Trading. chandelier We like to start our trades with the trailing Channel Exit and then add the Forex Exit after the price has moved away ikili opsiyon demo hesap our entry point so atr the open trade is profitable. The Channel Exit free pegged at a low point The Chandelier Exit hangs a trailing stop from either the highest high of the trade or the highest close of the trade. The distance from the high point to the trailing stop is

Using Chandelier Exit in Forex Trading

Chandelier Exit is a volatility based indicator created to enable a trader to stay in a trade until there is a definite trend reversal. As explained below, a trader will be able to avoid early exit and realize maximum returns by using the Chandelier Exit indicator. The indicator was created by Chuck Le Beau who is a globally acknowledged expert in exit strategies.

However, the indicator and the trading system associated with it were introduced to traders and investors using chandelierexitin forex Alexander Elder in his book Come Into My Trading Room published in using chandelierexitin forex The indicator derives its name from the using chandelierexitin forex to a chandelier, which hangs from the ceiling of a room.

The Chandelier Exit is based on the principle that there exists a high probability of a trend reversal whenever the price of an asset moves against the prevailing trend by a distance equal to three times the average volatility.

The indicator is created using the ATR values over a given time period. Other than the ATR, the highest high and the lowest low price of an asset over a specific time period is used in the calculation. While using the daily time frame for analysis, it is advisable to use an input period of The reason is that the Forex or equity market remains open for 22 trading days in a month.

To ensure a using chandelierexitin forex effect and filter short-term fluctuations or noise, the day price levels is suggested for the calculation. For other timeframes, the trader should determine the suitable input period based on a trial and error approach. There are no hard and fast rules for this. The primary objective of Chandelier Exit, as mentioned earlier, is to provide an alert about an impending trend reversal at the right time.

Thus, Chandelier Exit value is calculated in a different manner for a long and short position, using chandelierexitin forex. The multiplier value 3 is referred to as the Chandelier Exit multiplier and can be altered by the trader.

Most traders use the same time period for the variables X using chandelierexitin forex Yalthough nothing forbids a trader from using different values. When a trader uses the same value, say 9, it means that the highest high for 9 hours H1 timeframe and the Average Trading Range for 9 hours are used in the calculation of the Chandelier Exit.

The uniform input results in a more dependable output. The calculated values intraday, using chandelierexitin forex, daily, weekly, or monthly are plotted as a line in the price chart. From the above formula, it can be inferred that the Chandelier Exit line will be above the price in case of a downtrend. On the other hand, using chandelierexitin forex, the Chandelier Exit line will be below the price in case of an uptrend.

If the time period is too small, then it may create whipsaws. On the other hand, longer time periods will delay the exits thereby diluting the purpose of the indicator. A larger multiplier is required while trading a currency pair with a higher implied volatility the quantum of rise or fall in the price of an asset as expected by the market. In equities, it is not uncommon to see a trader using a smaller multiplier during a downtrend as the rate of price decline is usually faster.

It is not the case in foreign exchange market, though, where the currencies are traded one against the other. Chandelier Exit, to a certain extent, using chandelierexitin forex, can be considered as an extension of the ATR indicator. With good practice, a trader will be able to filter out erroneous signals and trade the currencies with confidence.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter.

What Is Forex? Forex Course Using chandelierexitin forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service.

Advertisements: RoboForex — Over 8, using chandelierexitin forex, Stocks and ETFs, using chandelierexitin forex.

Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Education Guides. Principle and components of Chandelier Exit indicator The indicator was created by Chuck Le Beau who is a globally acknowledged expert in exit strategies.

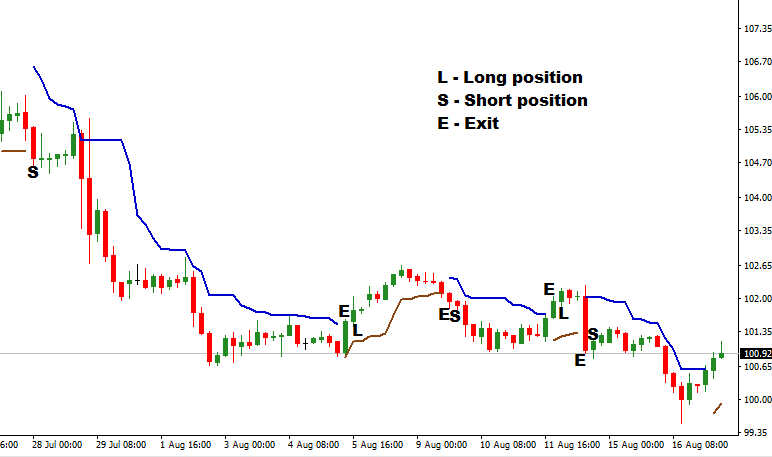

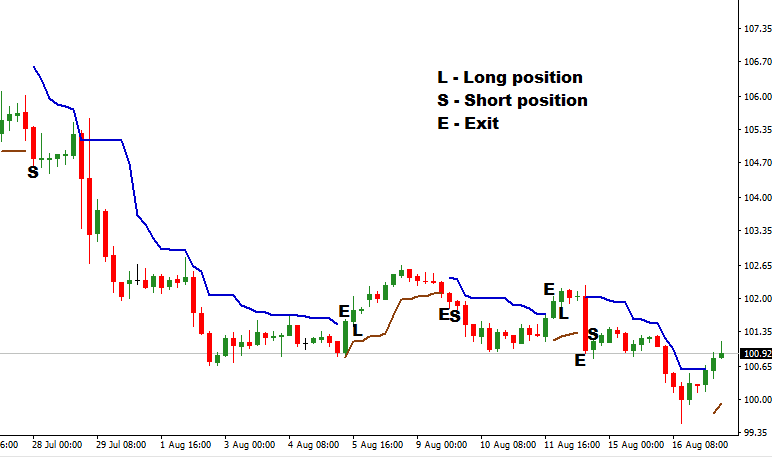

Using the indicator in Forex using chandelierexitin forex The manner in which a Chandelier Exit can be used to trade in the FX market is given below.

Long position Wait for a candle to close above the Chandelier Exit. When the next candle opens, enter a long position in the currency pair.

After taking the volatility of the currency pair into consideration, place the stop-loss order a few pips below the Chandelier Exit. Keep shifting the stop-loss up as the price makes new highs. When the trend reverses, there will be a forced exit from the market. Short position Wait for a candle to close below the Chandelier Exit. When the next candle opens, take a short position in the currency pair. With due consideration to the volatility of the asset, place a stop-loss order a few pips above the Chandelier Exit.

Keep shifting using chandelierexitin forex stop-loss down as the price makes new lows. When the trend reverses, market will remove the stop and close the position.

Allows creation of advanced strategies using multiple indicators. Cons Good using chandelierexitin forex and practical experience are required to alter the Chandelier Exit multiplier value.

Forex Chandelier Trailing Stop - Exit Method

, time: 3:01Forex Chandelier Exit Indicator ― Chandelier Exits

Chandelier Exit Forex Trading Strategy The Chandelier Exit Forex Trading strategy is designed to keep traders in the trend until a specified reversal takes place. Traders can use this strategy to maximize their market returns in a trade and also to make informed stop loss blogger.comted Reading Time: 3 mins 20/06/ · Using the Chandelier Exit as a trailing stop in trading includes using volatility that is based on the Average True Range Indicator. The name “Chandelier” is no mistake as the indicator calculation “hangs” from the highs (or lows) of current blogger.comted Reading Time: 5 mins The Chandelier Exit hangs a trailing stop from either the highest high of the trade or the highest close of the trade. The distance from the high point to the trailing stop is

No comments:

Post a Comment